How much should you spend on corporate gifting?

Request our corporate gift brochure to find the perfect gifts for clients and employees by budget and events.

Trusted by 410+ clients ⭐.

Most Indian companies spend between ₹500 to ₹2,000 per gift on corporate gifting, viewing it as a strategic investment that yields impressive returns.

Studies show that businesses experience a 306% increase in customer lifetime value and a 47% improvement in client retention.

In fact, 67% of companies maintain well-defined gifting budgets.

By actively enhancing client relationships and boosting employee engagement, corporate gifting proves to be a valuable tool for driving business growth.

Our study data shows that investment in corporate gifting consistently yields positive ROI across client relationships and employee engagement.

After reading this guide, you will gain insights into effective corporate gifting budgets, understand the factors influencing your spending, and learn how to implement a structured gifting program that drives positive business outcomes.

Contact us for a quick quotation and help: +91 9769378543

What is the average corporate gift cost?

The average corporate gift cost in India typically ranges from ₹5,00 to ₹2,000. This budget allows companies to choose a variety of thoughtful and personalized gifts that can enhance relationships with clients and employees.

Many organizations allocate funds based on the type of relationship and the occasion, ensuring that gifts are both meaningful and appropriate for recipients.

But before deciding the best corporate gift ideas, you should clearly know whether you should invest in gifting campaign now or later.

Should you need to invest in corporate gifting?

Let me state the fact: Not everyone should invest in corporate gifting. Just because other employees and companies are showcasing their corporate gift kits on social media doesn’t mean you need to jump in without making a strategic decision.

To make this process easier for you, we have created the following flowchart. Use the chart to determine whether you should invest in corporate gifting now or later.

Still not sure?

Answer the following questions and decide the right corporate gift ideas and budget for employees and clients.

1. Do you have clients or employees?

- Yes: If your business has clients or employees, it indicates that there are relationships to nurture. This is a critical first step because corporate gifting is primarily about strengthening these relationships.

- No: If you do not have clients or employees, there is no immediate need for corporate gifting. In this case, resources can be allocated to other areas of the business until such relationships are established.

2. Annual Revenue > ₹12L?

- Yes: If your annual revenue exceeds ₹12 lakh, it suggests that your business is in a position to invest more significantly in corporate gifting. This level of revenue typically allows for more substantial gifts that can have a greater impact on relationship building.

- No: If your annual revenue is less than ₹12 lakh, it may be prudent to start with a smaller budget of ₹500 per gift. This approach allows you to engage in corporate gifting without overextending financially, ensuring that you can still maintain cash flow while showing appreciation.

3. Looking to improve relationships?

- Yes: If the answer is yes, it indicates a proactive approach to relationship management. Implementing a structured gifting program can help systematically enhance connections with clients and employees, leading to long-term loyalty and engagement.

- No: If you are not specifically looking to improve relationships, you should assess whether you have retention issues with clients or employees.

4. Having retention issues?

- Yes: If you are facing retention issues, it’s crucial to address these concerns through a structured gifting program. Gifts can serve as a tool for recognition and appreciation, which may help improve retention rates by making clients and employees feel valued.

- No: If there are no retention issues, consider implementing periodic recognition gifts. These gifts can serve as tokens of appreciation for achievements or milestones without being part of a formal program.

ADDITIONAL CONSIDERATIONS:

Implementing a Structured Gifting Program

A structured gifting program involves planning and strategizing how gifts will be selected, when they will be given, and how recipients will be chosen.

This could include:

- Setting specific occasions for gifting (e.g., holidays, anniversaries).

- Creating guidelines for what types of gifts are appropriate for different recipients.

- Tracking the impact of gifts on relationships and overall business performance.

What are the factors that affect your corporate gifting budget?

When planning your corporate gifting budget, consider several key factors that can influence how much you allocate for each category.

Here’s a breakdown of the different categories and recommended dollar ranges for each type of gift.

Client Gifts

1. New Client Appreciation Gifts

These gifts serve to welcome new clients and establish a positive first impression. A thoughtful gift can set the tone for a fruitful partnership and encourage future collaboration.

Recommended budget: ₹4,000 to ₹10,000 per gift.

👉 Buy corporate gifts for clients

2. Long-term Client Retention Gifts

Investing in gifts for long-term clients helps maintain relationships and loyalty. These gifts demonstrate your commitment to their success and can lead to repeat business and referrals.

Recommended budget: ₹8,000 to ₹20,000 per gift.

3. Project Completion Gifts

Recognizing clients upon completing a project reinforces the partnership. It shows appreciation for their trust and collaboration, making them more likely to engage in future projects.

Recommended budget: ₹2,000 to ₹8,000 per gift.

4. Holiday Gifts

Holiday gifting is a common practice to express gratitude during festive seasons. These gifts can strengthen bonds and create a sense of goodwill, enhancing your brand’s reputation. Recommended budget: ₹3,000 to ₹10,000 per gift.

👉 Buy corporate gifts for travel

Employee Gifts

1. Service Anniversaries

Celebrating employee milestones fosters loyalty and morale. Acknowledging their dedication increase their motivation and sets a positive example for other employees. A well-chosen work anniversary gift strengthens the bond between the employee and the organization.

Recommended budget: ₹2,000 to ₹8,000 per gift.

👉 Buy service anniversary corporate gifts

2. Performance Recognition

Rewarding outstanding performance boosts motivation and retention. This recognition can be pivotal in creating a high-performance culture within your organization.

Recommended budget: ₹200 to ₹2,000 per gift.

👉 Buy employee recognition gifts

3. Special Occasions

Gifts for birthdays or personal achievements show appreciation for employees as individuals. Personal touches in gifting can significantly enhance employee satisfaction and engagement. Recommended budget: ₹1,500 to ₹5,000 per gift.

👉Buy eco-friendly corporate gifts

4. Team Building Events

Gifts during team-building activities enhance camaraderie and engagement. These gestures can help strengthen team dynamics and improve overall workplace morale.

Recommended budget: ₹2,500 to ₹7,500 per gift.

5. Holiday Gifts

Similar to client gifts, holiday gifts for employees help cultivate a positive work environment. They serve as tokens of appreciation that can boost team spirit during festive seasons. Recommended budget: ₹1,500 to ₹5,000 per gift.

👉 Buy diwali gifts for employees

Partner/Vendor Gifts

1. Relationship Maintenance

Regular gifts help strengthen partnerships with vendors and suppliers. By acknowledging their contributions, you foster goodwill that can lead to better service and collaboration down the line. Recommended budget: ₹4,000 to ₹10,000 per gift.

2. Special Occasions

Acknowledging milestones or achievements of partners can enhance collaboration. Celebrating these moments demonstrates respect and appreciation for their role in your business success. Giving thoughtful gifts on special occasions helps build stronger business relationships and shows your partners they are appreciated.

Recommended budget: ₹2,000 to ₹16,000 per gift.

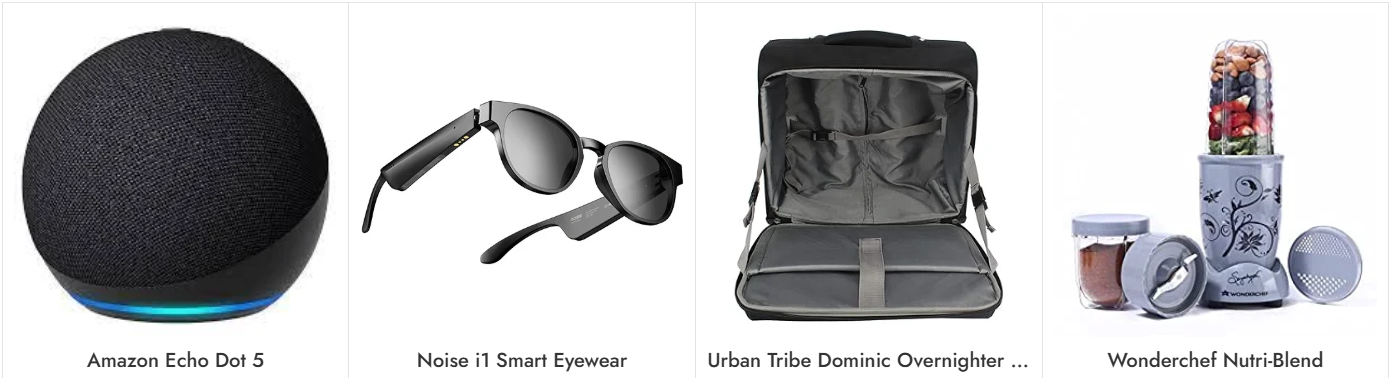

Other Gifting options are: Corporate gifts under 2000, Corporate gifts under 500, 2025 corporate diaries, New joinee kits and more.

How to decide your corporate gifting budget?

A well-defined budget not only ensures effective allocation of resources but also maximizes the return on investment (ROI) from gifting strategies.

Here’s a detailed approach to help you decide your corporate gifting budget.

1. Determine your overall budget

Start by assessing the total amount your business can allocate for corporate gifting. This involves reviewing your financial position and understanding how much you can afford without straining your resources.

Example Calculation: If your annual revenue is ₹1.2 million and you decide to allocate ₹10,000 for corporate gifting, this sets a clear starting point.

2. Calculate the number of gifts needed

Identify how many gifts you plan to give throughout the year. This includes gifts for various occasions such as holidays, employee milestones, or client appreciation events.

Example: If you have 100 employees and plan to gift them five times a year, you will need 500 gifts.

3. Set a per-gift budget

Once you know how many gifts you need, establish a budget for each gift. This helps in narrowing down options that fit within your total budget.

Example Calculation: If you need 500 gifts and have a total budget of ₹10,000, then each gift can be priced at ₹200.

4. Prioritize your recipients

Segment your audience based on their importance to your business. High-value clients and top-performing employees may warrant a larger portion of the budget compared to general gifts for all employees.

Recommendation: Use a tiered approach where different groups receive varying levels of gifts based on their contribution or relationship with the company.

5. Consider the frequency of gifting

Decide how often you will give gifts throughout the year. This could be quarterly, biannually, or during specific events.

Example: If you plan to give gifts four times a year, consider how much of your total budget will be allocated for each occasion.

6. Evaluate and adjust based on ROI

After implementing your gifting strategy, continuously evaluate its effectiveness in achieving business goals such as increased client retention or employee satisfaction.

ROI Calculation: Use the formula to assess whether your spending is yielding positive returns.

ROI = (Revenue increase + Cost savings) / Gift cost

Why choose TapWell for your corporate gifting requirements?

TapWell stands out as India’s premier corporate gifting partner with 9 years of proven experience and over 1,800 successful projects. Their extensive range of 4,300+ products accommodates all budgets, from Rs 100 to Rs 5000 per piece.

The company excels in customization, offering corporate branding, personalized names, and custom hampers. With a low minimum order quantity of 30 pieces, a quick 5-7 day turnaround, and partnerships with major logistics providers, TapWell ensures seamless delivery nationwide and internationally.

Rases Changoiwala

Rases Changoiwala is a Corporate Gifting Expert with over 9 years of experience in the industry. He is the CMO and Co-Founder of TapWell, a leading Corporate and Employee Gifting brand in India, a company he bootstrapped with his wife in 2015. His passion lies in curating personalized gift experiences that strengthen relationships and bring joy.